2025-09-29

Five essential steps to a better budget

Lifestyle Debt

A clear, realistic budget can help you reach your goals faster. Learn five practical steps to take control of your finances and spend with confidence.

2016-12-06

Canadians plan to spend 17 per cent more this Christmas than last, according to Accenture’s annual Canada Holiday Shopping Survey, an average of $873 compared to the $744 they expected to spend last year. But most have not accounted for the additional unexpected costs around the holidays and many will go over budget.

While 36% of Canadians said they planned to keep their debt in check last Christmas, The Royal Bank of Canada’s 2016 Post Holiday Spending Poll revealed that 41 per cent of respondents overspent on holiday gifts, putting themselves $397 deeper into debt on average: the highest point in five years.

“Many people go into the holidays having a budget, believing they can stick to it, but the costs of gifts, décor and food and drinks can end up being far more than expected. Putting the balance on credit seems like an easy solution at the time, but it can really blow the holiday budget,” warns Lana Gilbertson, a government Licensed Insolvency Trustee at MNP Debt.

Gilbertson cites last minute hostess gifts, guilt gifts for neighbours who drop by, and even the unexpected shipping and postage costs of sending gifts abroad as ways Canadians can go over budget without realizing.

“Unexpected expenses can quickly send even a carefully calculated budget into a tailspin. No one wants to feel like the Grinch, so many end up relying on credit cards, even though they may be unable to pay off the bill in January.”

Overspending on unexpected expenses can push many people into the red, but according to Gilbertson, what can compound the problem is the unexpected costs of accrued interest on credit cards. Interest is an expense that doesn’t end up wrapped under the tree, but it is a holiday expense many Canadians neglect to consider.

“People might think they got a really good deal on Black Friday or Boxing Day but overspending on credit during the holidays means paying high interest rates every month afterwards. Those ‘perfect’ gifts suddenly end up costing a lot more than expected when you add the interest accrued to the original sticker price of the item,” explains Gilbertson.

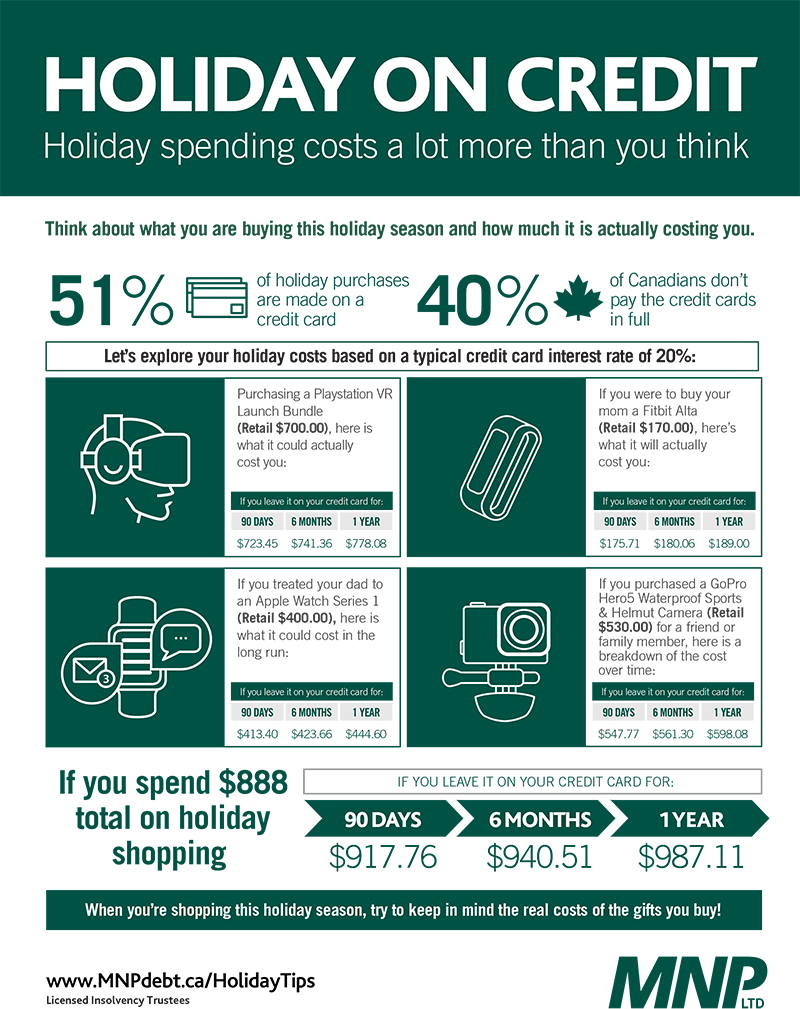

Canadians plan to spend an average of $873 on the holidays this year, according to Accenture. If that balance is left on a credit card for 90 days, that $873 would actually cost them $902.25. If left on a credit card for 6 months, those Christmas expenses would ultimately cost $924.60. An entire year of paying the minimum payments would cost a grand total of $970.44. The holidays may be been merry and bright, but those accrued interest costs can really put a damper on the coming year.

Here’s what popular Christmas gifts could actually cost, if purchased on credit:

You buy your son/daughter a Playstation VR Launch Bundle (Retail $700.00):

You buy your mom a Fitbit Alta (Retail $170.00):

You buy your dad an Apple Watch Series 1 (Retail 400.00):

You buy your wife/husband a GoPro HERO5 Waterproof Sports & Helmut Camera (Retail $530.00):

Gilbertson advises Canadians to start shopping now instead of last minute, and use cash to stay within budget.

“Leaving shopping to right before the holidays often results in spending more. Instead, spend some time now to find smaller more thoughtful gifts, which will help avoid the last minute scramble to wow with an expensive gift. Cash is best, but if using credit cards, be sure to keep a close eye on budgeting. Debt can easily snowball after the holidays, so being more conscious of spending now will make it easier to pay down credit cards come January.”

2025-09-29

Lifestyle Debt

A clear, realistic budget can help you reach your goals faster. Learn five practical steps to take control of your finances and spend with confidence.

2024-11-15

Lifestyle Debt

MNPs LITs are happy to review your financial situation and discuss your options during a Free Confidential Consultation. Together, we can help you achieve a fresh financial start.

2024-11-13

Lifestyle Debt

These financial goals help you make sure all your needs are met and provide you with the ability to deal with unexpected events like vehicle and /or house repairs.