2025-09-04

Will Bankruptcy Erase All Of My Debt?

Bankruptcy

The intention of Canadian bankruptcy law is to provide honest and overextended debtors the opportunity for a financial fresh start.

Bankruptcy is a legal process that helps provide immediate financial protection to people experiencing overwhelming financial difficulties.

To file for personal bankruptcy, an individual must have at least $1,000 in debt that they’re unable to repay. These can include debts such as credit card bills, loan payments, utility bills, payday loans, and mortgage payments.

If you’ve had your wages garnisheed, received past-due notices, or calls from debt collectors, bankruptcy might be right for you.

Though typically a last resort, bankruptcy allows you to solve your debt problems fast with the help of a Licensed Insolvency Trustee (LIT) who will guide and support you through the process.

| Advantages | Disadvantages |

|---|---|

| Immediately stop collection action, interest, and garnishees. | Certain assets vest with the LIT. |

| Certain assets are exempt from seizure (e.g. vehicles, household furnishings, tools of the trade, certain retirement savings). | Monthly income and expense reports must be submitted to Trustee for review. |

| Creditors can’t refuse bankruptcy. | Surplus income payments may fluctuate according to monthly income. |

| LIT will often assist with filing outstanding personal income tax returns. | Creditors can oppose discharge and a court hearing may be required to get out of bankruptcy. |

| Process lasts between nine and 21 months if you have never been bankrupt before, which is less than a typical consumer proposal. | Negatively impacts your credit score for six years after completion. |

| No limit on the size of debt load to be eligible to file. | Some tax refunds are turned over to the LIT. |

| Budgeting and money management counselling are provided. | |

| You repay less than you owe. |

People often realize they can't pay their debts all at once, after a big financial problem, or slowly over time when they see their current plan isn't working. If you see any of these signs, talk to your local MNP Licensed Insolvency Trustee for a free confidential consultation. Together, you will review your entire financial situation and discuss your options for a financial fresh start.

To file for bankruptcy, certain conditions must be met:

Meeting these requirements does not mean you must file for bankruptcy — other options can be explored with the help of an LIT.

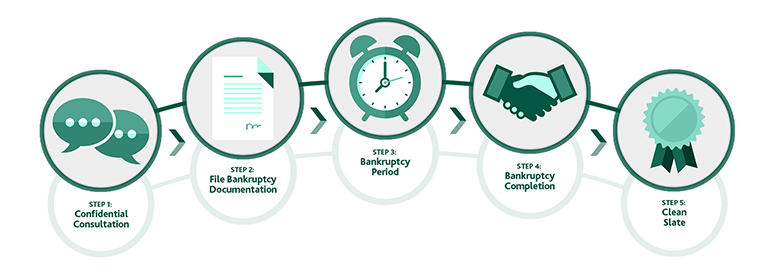

Timeline: Now

The first step in determining whether bankruptcy is the best choice for you is to meet with one of our Licensed Insolvency Trustees. They will review all your options, which include doing nothing, debt consolidation, credit counselling, bankruptcy and consumer proposals.

This initial consultation includes a summary of your debts, assets, income, and expenses. We will also discuss what assets are exempt in your province and what the term surplus income would mean for you in bankruptcy.

If bankruptcy is your ideal debt relief option for your unique situation, we will then review the process with you in detail and make sure you understand all the implications.

Timeline: Immediately, once information is available

Your Licensed Insolvency Trustee will assist you in preparing and filing all required documents with the federal government's Office of the Superintendent of Bankruptcy (OSB), including a Statement of Affairs (a sworn declaration of your assets, debts, income, and expenses). A Stay of Proceedings comes into effect as soon as this is filed, meaning your creditors can no longer phone or sue you, and any existing garnishees are halted.

Timeline: 9 – 21 months

During the bankruptcy time frame (which is nine months for your first bankruptcy unless you have surplus income), you will generally do the following four things:

Timeline: 9 – 21 months

You will automatically receive your discharge (your release from bankruptcy and the debts you owe) at the nine or 21-month mark. This is only if you have completed all the necessary steps as outlined above and a creditor or other stakeholder does not oppose your discharge.

If you do not complete the required tasks, you will not be released from bankruptcy until those missing steps are completed. A court order will outline the remaining steps you must follow. The discharge time frames are for a first-time bankrupt person.

Timeline: The rest of your life

During your financial counselling sessions, your Licensed Insolvency Trustee will discuss ways to restore your credit rating during and after the bankruptcy period. Improvements to your credit rating will take time but once the bankruptcy is completed, you will have no remaining unsecured debts (with minor exceptions).

Filing for bankruptcy or a consumer proposal will hurt your credit rating; however, the overall impact may vary. Bankruptcy will likely drop your credit score to the lowest possible level and affect your credit worthiness. It also stops the clock on any damage currently being reported by debt collectors, so you can focus on rebuilding your credit score. A bankruptcy will remain on your credit report for six years after discharge.

Provincial guidelines will determine which assets you can keep, such as a car and house, up to a certain value, as well as RRSPs and RESPs.

A bankruptcy or consumer proposal can clear most, if not all, of your debts. Both options can eliminate unsecured consumer debts like credit cards, lines of credit, store credit cards, payday loans, tax debts, and most judgment debts from past or pending lawsuits. Unsecured debt comes from credit extended without any collateral — an asset provided to the lender as a guarantee of repayment.

Certain debts cannot be cleared through bankruptcy in Canada for various reasons. These include secured debts, alimony or child support payments, court-imposed fines and parking tickets, student loans under seven years old, and some debts resulting from fraud.

To find out more about what debts survive bankruptcy, read our blog.

If you’re struggling with debt but also have assets you wish to keep, a consumer proposal might be the life-changing debt solution you’re looking for.

View Consumer Proposal

You may be able to combine multiple debts into one overall loan—provided by your bank or financial institution—to make budgeting for repayment easier.

View Debt Consolidation2025-09-04

Bankruptcy

The intention of Canadian bankruptcy law is to provide honest and overextended debtors the opportunity for a financial fresh start.

2025-08-01

Bankruptcy

If you’re struggling with your finances and heading toward bankruptcy, you may think it makes sense to sell or transfer some of your assets.

2025-06-30

Bankruptcy

There are several common scenarios which may cause you to wonder whether personal bankruptcy is an appropriate option to get out of debt.