When to Call a Corporate Recovery Professional

When you’re working 24 / 7 to drive growth, it is not always easy to get a comprehensive picture as to your business’ true financial situation — and where it’s headed. If you start noticing that your business is in a cash crunch or your gross margins are slightly lower than what they used to be, staying ahead of the game and meeting with a professional advisor will allow you to gain a better perspective into the various key considerations in your organization’s performance and needs and to implement early intervention with the objective of getting your business back on track. An ounce of prevention is worth a pound of cure!

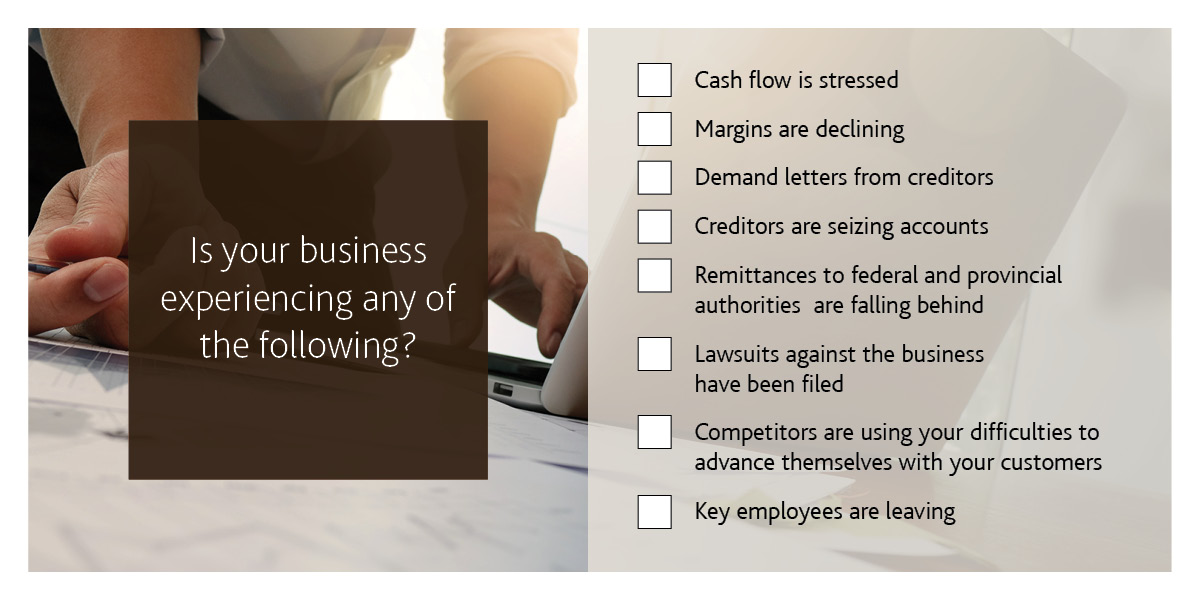

Unfortunately, all too often, organizations wait until the last minute to identify the fact that they need a recovery plan when they are on the verge of financial ruin. Last minute triggers can include, demanding letters from financial institutions, creditors seizing accounts and facing lawsuits or being unable to pay the necessary government installments.

If your business is facing challenges, regardless of your interpretation of where you are with signs and symptoms, the time to act is now. You should contact a corporate recovery and restructuring professional at MNP and put yourself on a track to regain financial health.

If you can check off even one of these boxes, seeking the advice of a corporate recovery and restructuring professional as soon as possible can make all the difference in getting back on track to financial health. In this insightful video, Sheri Aberback, a Licensed Insolvency Trustee and Corporate Recovery and Restructuring Professional goes into greater detail about how to recognize the signs of a struggling business and why early intervention is the best approach.

Why Choose MNP?

MNP is unique in that we are entrepreneurial in spirit and in practice. Many members of our team have worked in industry, which means we empathize and understand better the challenges facing an entrepreneur. We understand the human dynamics that occur when you’re dealing with people (employees, suppliers, customers, stakeholders) and not just financial numbers. There are many emotional decisions that have to be made (this is your business and possibly your family legacy). It is our role to go through the emotional journey with you and help the organization develop a more objective perspective in order to come out of the current predicament, healthier and financially stronger at the end of the day. From comprehensive financial statement analysis, business plans, implementation schedules, discussions with bankers, alternate lenders to exit scenarios and more, we can help with all aspects of financial and operational plans for a turnaround, recovery and restructuring.

National in scope and local in focus, MNP Ltd., through our parent firm, MNP LLP, has an extensive network of specialists serving clients in numerous industry and specialty groups, including: Aboriginal, Agriculture, Credit Unions, Forestry, Manufacturing, Mining, Oilfield Services, Private Enterprise, Professionals, Public Companies, Real Estate & Construction and Technology. Working together, our Licensed Insolvency Trustees and corporate recovery specialists provide insight into these and other sectors to help our clients overcome financial challenges and seize opportunities.

Because we are a national firm, we are always able to make sure we have the right people in the right place, at the right time. Whether we are bringing in professionals from Vancouver or Atlantic Canada, our priority is to always do what’s best for the client, what’s best for the file and what’s best for the mandate — and we’re able to tap into those resources seamlessly from coast-to-coast.

Sheri Aberback is a Licensed Insolvency Trustee and Corporate Recovery and Restructuring Professional serving our Montreal region. For more information on how MNP Ltd can help, contact our local office at 514-932-4115.