Rising interest rates and inflation forcing Canadians to make tough budget decisions to make ends meet

More than a quarter will cut back on essentials such as food, utilities and housing; nearly half will cut back on non-essentials such as travelling, dining out and entertainment

- Six in 10 say they’re already feeling the effects of interest rate increases (59%, +7pts).

- Nearly half say they’re cutting back on non-essentials such as travelling, dining out, and entertainment (46%).

- A third are buying cheaper versions of everyday purchases (37%) and driving less (30%).

- More than a quarter are cutting back on essentials such as food, utilities, and housing (27%).

CALGARY, AB – July 11, 2022 – Canadians are becoming acutely aware of how interest rates and the cost of necessities impact their household budgets, as both measures continue on a months-long upward trajectory. Increasing a staggering seven points since last quarter, six in 10 (59%) Canadians say they’re already feeling the effects of interest rate increases, according to the latest MNP Consumer Debt Index which is conducted quarterly by Ipsos on behalf of MNP LTD.

Many Canadians are now being forced to make tough budget decisions to make ends meet. Nearly half (46%) say they’re cutting back on non-essentials such as travelling, dining out, and entertainment — while a third are buying cheaper versions of everyday purchases (37%) and driving less (30%). More than a quarter (27%) are making the difficult decision to cut back on essentials such as food, utilities, and housing.

Women (49%) and those aged 35-54 (48%) are significantly more likely to say they’ll be cutting back on non-essentials compared to men (42%) and those aged 18-34 (39%). Women (30%) and those aged 35-54 (25%) are also more likely to say they’ll be cutting back on non-essentials compared to men (24%), those aged 18-34 (25%), and those aged 55+ (24%). Only one in 10 (12%) are fortunate enough to say they don’t have any increased expenses to pay for.

“No matter where Canadians turn, there is no reprieve. Housing is more expensive; driving a car is more expensive; food is more expensive,” says Grant Bazian, President of MNP LTD., the country’s largest insolvency firm.

“Many households are trying to adjust their budgets and cut costs where they can to keep up with their monthly bills. But it’s likely to get worse before it gets better — households will have to make increasingly difficult choices about what to cut as the cost of living continues to rise. Some could find themselves piling on debt to make ends meet.”

Further indication that Canadians could be in for a rough rest of the year, half (50%, -1) of Canadians say they will be in financial trouble if interest rates go up much more. Women (55%) and those aged 18-34 and 35-54 (63%) are more likely to agree they will be in trouble compared to men (45%), those aged 18-34 (62%), and those aged 55+ (30%). Four in ten (39%, unchanged) say rising rates could drive them closer to Bankruptcy.

Almost a quarter (24%) say they’re not financially prepared to deal with an interest rate increase of one percentage point, up two points from last quarter. Moreover, more than half of Canadians say they’re concerned about the impact of rising interest rates on their financial situation (58%, +1pt) and their ability to cover all living / family expenses in the next year without going further into debt (55%, +2pts). The proportion who are concerned about the impact of rising interest rates is up 13 points since June 2017.

“There’s mounting pressure for more aggressive interest rate hikes to tame inflation rates which are at a 40-year high. Canadians who aren’t financially prepared to absorb future interest rate increases will likely find themselves unable to manage the increasing costs of their debt repayment obligations,” says Bazian.

While the vast majority of Canadians (82%, +1pt) agree they’ll be more careful with how they spend their money, more than half (56%, -1pt) say they’re more concerned about their ability to pay their debts as interest rates rise. Two in five say they’re concerned about their current level of debt (41%, unchanged) and regret the amount of debt they’ve taken on in life (42%, -2pts).

Bazian advises those concerned about upcoming bills and debt repayments to speak with a federally-regulated Licensed Insolvency Trustee who can help determine the best debt-relief solution through a confidential and unbiased assessment of their financial situation.

“There comes a point when even the strictest budget won’t be enough to stave off financial problems,” says Bazian. “Only Licensed Insolvency Trustees can provide the full range of debt-relief options to release individuals from their debts and help them obtain a fresh financial start, including Consumer Proposals and Bankruptcy.”

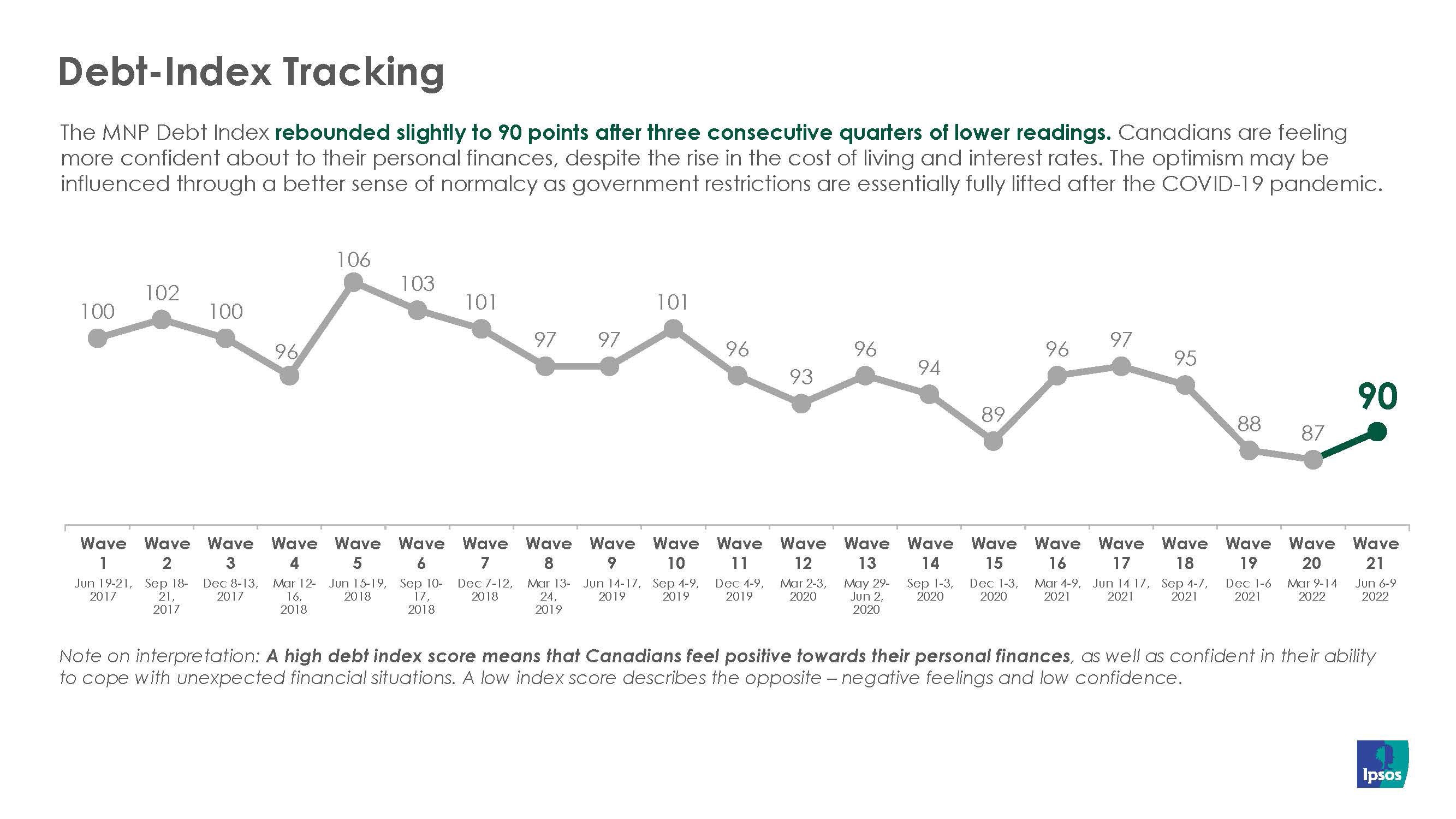

The MNP Consumer Debt Index is now in its fifth year of tracking Canadians’ attitudes about their debt situation and their ability to meet their monthly payment obligations. Despite the current economic environment with rising inflation and a surging cost of living, Canadians’ financial confidence has crept up slightly from last quarter. Now in its twenty-first wave, the Index increased three points since last quarter to 90 points — but remains well below the benchmark score established five years ago.

The Index was averaging high 90s and over 100 prior to and throughout the pandemic, but Canadians’ confidence in their personal financial situations has struggled to return to pre-pandemic scores.

The MNP Consumer Debt Index rebounded slightly to 90 points after three consecutive quarters of lower readings and two successive record lows. The Index was averaging high 90s and over 100 prior to and throughout the pandemic, but confidence has struggled to return to pre-pandemic scores.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 240 offices from coast to coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools. For regular, bite-sized insights about debt and personal finances, subscribe to the MNP 3 Minute Debt Break Podcast.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians.

Now in its twenty-first wave, the Index has increased three points since last quarter to 90 points, although remaining well below its benchmark score established five years ago. Visit MNPdebt.ca/CDI to learn more.

The data was compiled by Ipsos on behalf of MNP LTD between June 6 and June 9, 2022. For this survey, a sample of 2,000 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error and measurement error.

A summary of some of the provincial data is available by request.