One in three already technically insolvent, up seven points.

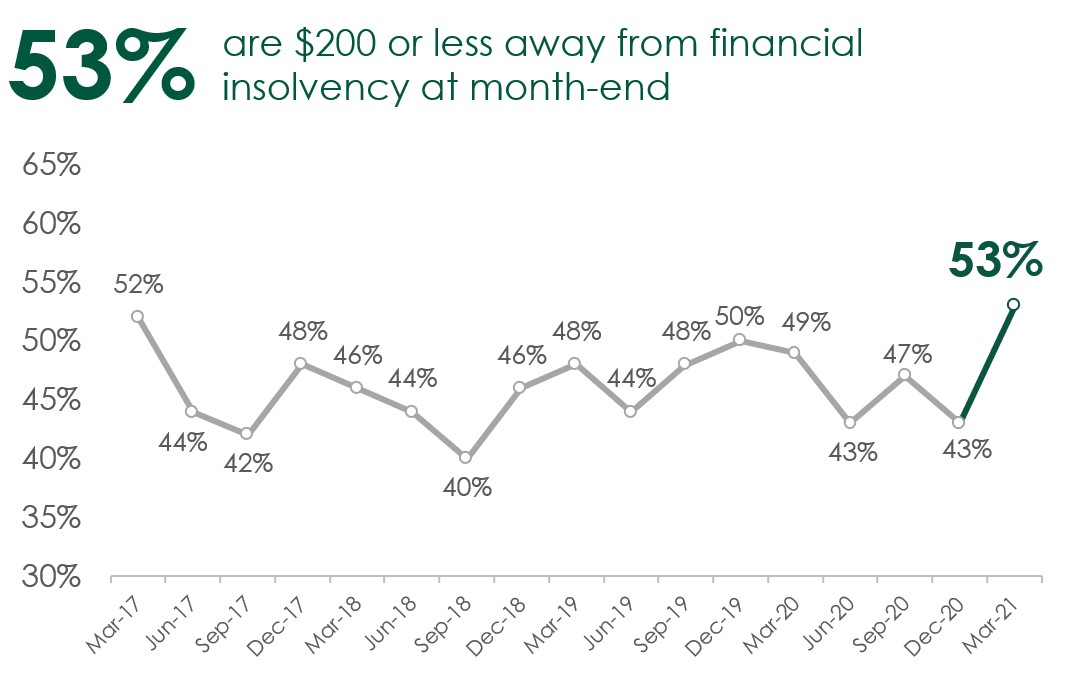

CALGARY, AB – April 8, 2021 – As pandemic-related government aid and loan deferral programs begin to wind down, the latest MNP Consumer Debt Index finds the number of Canadians hovering close to financial insolvency has reached a five-year high. More than half (53%) say they are $200 or less from not being able to meet all of their bills and debt obligations each month, a whopping 10-point jump from December. This includes three in 10 (30%, +7pts) who report they are already insolvent with no money left at month-end to cover all their payments.

“Pandemic-related financial relief measures provided some breathing room over the last year, but now we’re seeing a reversal,” says Grant Bazian, president of MNP LTD, the country’s largest insolvency firm. “The number of Canadians with virtually no wiggle room in their household budgets has reached a five-year high. The anxiety Canadians are feeling about making ends meet — or already being unable to do so — tells us we may see an avalanche of households falling behind on payments or defaulting on loans, mortgages, car payments, or credit cards.”

Conducted quarterly by Ipsos and now in its sixteenth wave, the Index finds households report having less money left over at the end of the month. On average, Canadians say they are left with $625 after making their payments, down by $108 or 15 percent from December. The decline is likely a reflection of the government aid programs, eviction bans, and payment extensions that are now ending.

“Some Canadians may be seeing their bills coming due, even if they are not back to full-time employment,” says Bazian. “Even though some Canadians are spending less and saving more as a result of pandemic measures, others are being pushed further into the red — taking on more debt to stay afloat after job, wage, or small business losses.”

A quarter (25%) of Canadians say they have taken on more debt because of the pandemic. This includes using credit cards (14%), using a line of credit (7%), taking out a bank loan (3%), or deferring mortgage payments (3%). One in five (20%) has also reported raiding their emergency savings to pay their bills.

“Those taking on more debt are becoming increasingly vulnerable to interest rate increases in the future. They may find their debt rapidly becoming unaffordable when those invariably happen,” explains Bazian.

Over half (51%) are concerned about their ability to repay debts if interest rates rise. About four in 10 (35%) are concerned that rising interest rates could move them towards Bankruptcy.

Despite the concern, six in 10 (59%) believe now is a good time to buy things that they otherwise might not be able to afford (-2 from December). In addition, nearly half (49%) say they’re more relaxed about carrying debt than they usually are (+2 from December).

“Unfortunately, using credit is a reflex for many Canadians. For those concerned about the mid- to long-term consequences, it is probably a good time to start thinking of debt as a trap, rather than the solution,” says Bazian, who urges Canadians to be proactive about improving their financial positions and advises anyone who is concerned about their consumer debt to seek professional advice.

However, the survey found very few Canadians plan to get professional advice (4%) or contact a Licensed Insolvency Trustee to discuss debt relief options (2%) over the next year. Instead, it seems many plan to do exactly what Bazian cautions against: taking on even more credit to pay their expenses. More than a quarter (26%) say they plan to take on more debt to pay bills over the next year, including using high-interest options like credit cards (8%) or payday loan service (2%).

“I cannot stress this enough: Deeply indebted individuals — particularly those who find themselves taking on more debt to pay bills — should seek professional debt advice right away. Bankruptcy is not the only option, nor is it always the best option for dealing with debt. Licensed Insolvency Trustees offer free, unbiased advice about your individual situation and the options available,” says Bazian.

Government-regulated Licensed Insolvency Trustees are empowered to help Canadians reorganize their financial affairs and, where appropriate, can even help them avoid Bankruptcy by facilitating an agreement with their creditors. They can also guarantee legal protection from creditors through the Consumer Proposal or Bankruptcy processes.

Bazian says a Licensed Insolvency Trustee may recommend one or a combination of the following depending on the extent of the debt and the individual’s overall financial situation:

Budgeting — Setting up a monthly financial plan to help balance and monitor income and expenses and potentially free up more cash to pay down debt.

Refinancing — Re-negotiating the term and interest rate on existing credit accounts to reduce the monthly cost of debts and make them easier to repay.

Liquidating — Selling high-value assets such as non-essential vehicles, recreational properties, sporting goods, and jewelry to provide the financing to pay down debt.

Consolidating — Combining all debts into a single monthly payment with a lower average interest rate to reduce the number of payments and their total cost.

Consumer Proposal — Working with a Licensed Insolvency Trustee to negotiate a legally binding debt settlement with creditors that will reduce the amount owed and can be paid over a maximum of five years. Consumer Proposals can only be administered by Licensed Insolvency Trustees.

Bankruptcy — A legal process of liquidating assets and potentially making monthly payments to eliminate outstanding debts and help insolvent consumers achieve a financial fresh start. A Bankruptcy may only be administered by a Licensed Insolvency Trustee.

“Everyone’s situation is different, which why it is important to get customized, unbiased advice from a Licensed Insolvency Trustee. They are the only debt-relief professionals in Canada who can offer the full range of debt-relief options and help severely indebted individuals understand their rights and determine the best path forward,” adds Bazian.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 240 offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools. For regular, bite-sized insights about debt and personal finances, subscribe to the MNP 3 Minute Debt Break Podcast.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians.

Now in its sixteenth wave, the Index currently stands at 96 points, up seven points compared to the last wave conducted in December 2020. Visit MNPdebt.ca/CDI to learn more.

The latest data, representing the sixteenth wave of the MNP Consumer Debt Index, was compiled by Ipsos on behalf of MNP LTD between March 4-9, 2021. For this survey, a sample of 2,001 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error and measurement error.