Filing for personal Bankruptcy can be an emotionally-charged experience. Without someone to provide you with all of the information and support you need, it can feel overwhelming. Our Licensed Insolvency Trustees are here to walk you through each step in the process, including whether declaring Bankruptcy is actually the best Life-Changing Debt Solution for you. We will provide the peace-of-mind and guidance you need during this transition, to end the cycle of debt for good.

How Filing for Bankruptcy in Canada Works

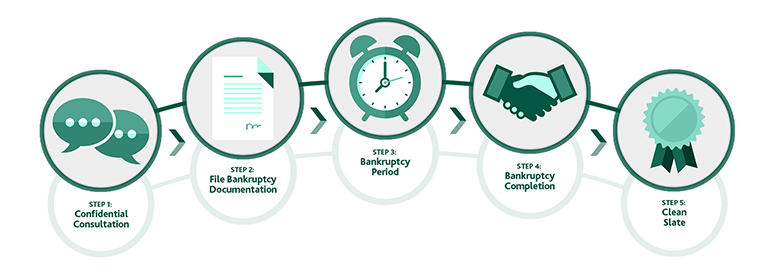

- Set up a Free, Confidential Consultation

Timeline: Now

The first step in determining whether Bankruptcy is the best choice for you is to meet with one of our Licensed Insolvency Trustees to review all of your options, including doing nothing, debt consolidation, credit counselling, Bankruptcy and Consumer Proposals. This initial consultation includes the development of a summary of your debts, assets, income and expenses. We will also have a discussion on what assets are exempt in your province and what the term surplus income would mean for you in a Bankruptcy. After going through your options, if a Bankruptcy is your ideal debt relief option for your unique situation, we will then review the process with you in detail and make sure you understand all the implications.

- Legally File for Bankruptcy

Timeline: Immediately, Once Information Is Available

Your Licensed Insolvency Trustee will assist you to prepare and then file all required documents with the federal government's Office of the Superintendent of Bankruptcy (OSB), including a Statement of Affairs (a sworn declaration of your assets, debts, income and expenses). As soon as this is filed, a Stay of Proceedings comes into effect, meaning your creditors can no longer phone or sue you and any existing garnishees are lifted.

- Bankruptcy Period

Timeline: 9 to 21 Months

During the Bankruptcy time frame (which is nine months for a first time bankrupt, unless you have surplus income) you will generally do the following four things:

- File monthly income and expense reports with your Licensed Insolvency Trustee to both monitor whether you have Surplus Income and to help you track your expenses and develop a budget.

- Attend two counselling sessions — the first within three months, the second before end of process. During these sessions, you will discuss the causes of your financial difficulty, tracking expenses and budgeting, restoring your credit rating and other long-term debt management strategies.

- Provide your Licensed Insolvency Trustee all required information to complete your tax returns for the year in which you file Bankruptcy (and prior years if appropriate).

- Pay any required amounts to your Licensed Insolvency Trustee. These payments may be required surplus income payments and / or payments to repurchase an asset that is not exempt, or they might simply be the minimum amount required to cover the costs of administration.

- Bankruptcy Discharge

Timeline: 9 to 21 Months

You will automatically receive your discharge (your release from the Bankruptcy and the debts you owed when you filed) at either the 9- or 21-month mark, assuming you have done all the necessary steps as outlined above and no one objects. If you do not complete the required tasks, you will not be released from the Bankruptcy until those missing steps are concluded. A court order will be set, outlining the remaining steps you need to complete. The discharges time frames are for the first time, bankrupt person.

- Debt-Free. For Life.

Timeline: The Rest of Your Life

During your mandatory counselling sessions, your Licensed Insolvency Trustee will discuss with you ways to restore your credit rating both during the Bankruptcy period and afterwards. Improvements to your credit rating will generally take some time but, once the Bankruptcy is completed, you will have no remaining unsecured debts (with minor exceptions). Click here to learn more.