2025-10-21

How we helped a client decide between a consumer proposal and bankruptcy

A client thought bankruptcy was their only way out. See how a consumer proposal helped them keep their home and repay debt with confidence.

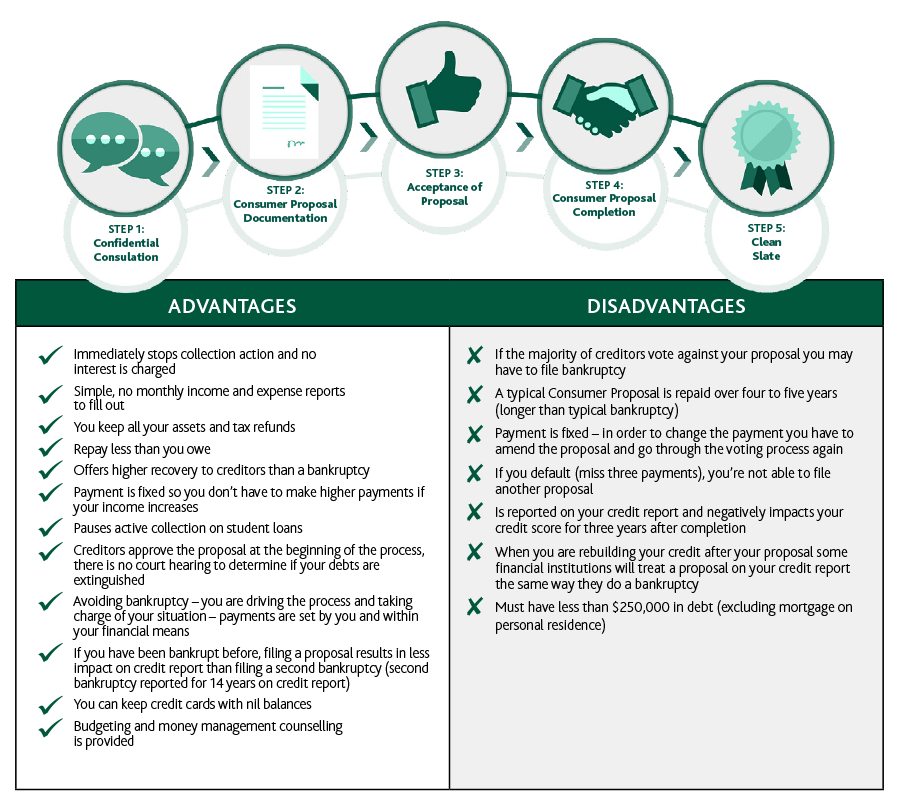

Consumer Proposals and bankruptcies are both government legislated options which can provide you with relief from significant debt problems. In addition, both debt solutions can only be administered by a Licensed Insolvency Trustee and provide a legal stay of proceedings which require creditors to discontinue harassing collection calls, garnishment or other legal proceedings.

Determining which, if either, option is an appropriate solution in your own unique situation depends on a number of variables. Let’s explore the advantages and disadvantages of both a Consumer Proposal and a bankruptcy.

2025-10-21

A client thought bankruptcy was their only way out. See how a consumer proposal helped them keep their home and repay debt with confidence.

2025-10-20

Alternatives to Bankruptcy Bankruptcy Consumer Proposal Lifestyle Debt MNP Consumer Debt Index

Just when seniors should be relaxing and enjoying the fruits of their labour, many find themselves struggling financially — an unsettling contrast to the ease they’d hoped to live their golden years.

2025-10-17

This is called buyer’s remorse. In some cases, Canadian law provides protections that can help you reverse these costly decisions and avoid sinking further into debt.