2025-11-11

Who will know I’ve filed for Bankruptcy?

Bankruptcy

You may be considering filing for Bankruptcy — and worried about who may find out. Learn who will be notified when you declare Bankruptcy.

Although filing a Consumer Proposal is generally a better option than filing for bankruptcy, overcoming any kind of debt challenge requires the guidance and care of an experienced Licensed Insolvency Trustee. Our team takes your personal situation into careful consideration and will build a debt repayment agreement to satisfy your creditors, so you can stop worrying and start living. That's what Life-Changing Debt Solutions are all about.

Many Canadians believe bankruptcy is the only solution to their debt problems. However, there are other options that provide relief from debt without having to file a bankruptcy. In some cases, a consumer proposal may be a viable alternative.

Download our ebook to review the basic facts about consumer proposals so you can understand how it works, its potential benefits and drawbacks, and how it compares to other debt-relief solutions.

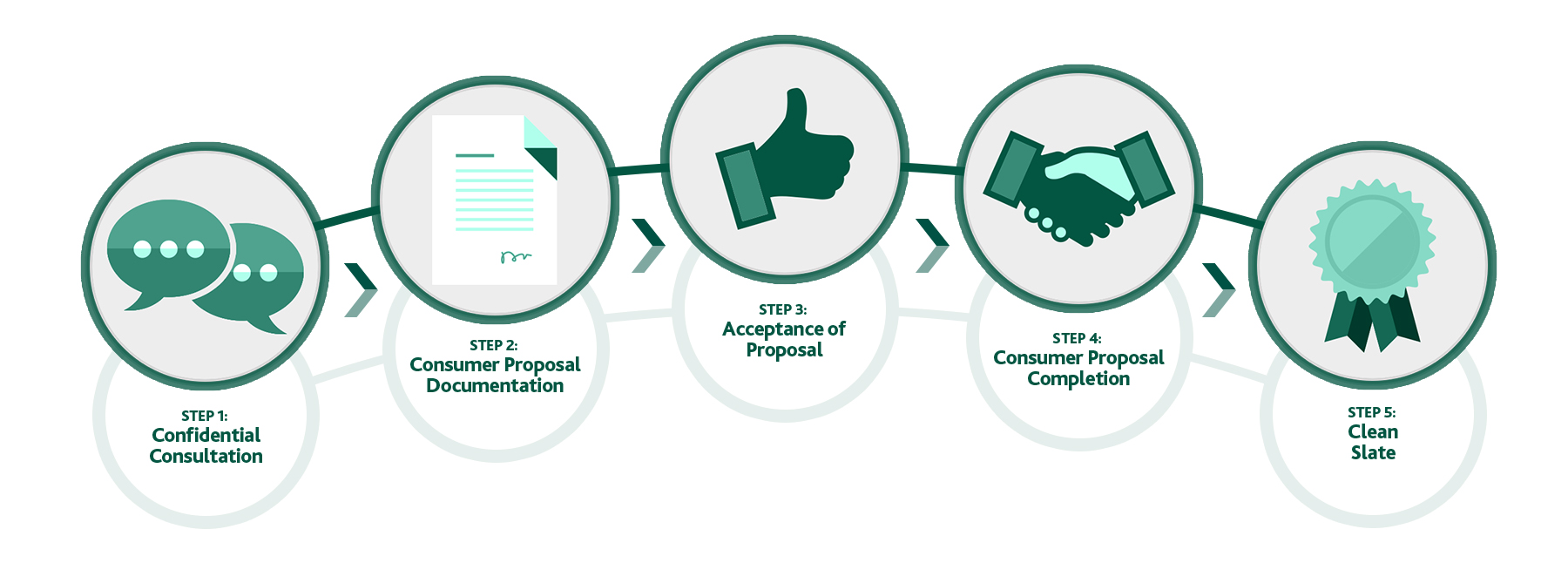

How Filing a Consumer Proposal in Canada Works

The first step in determining whether a Consumer Proposal is the best choice for you is to meet with one of our Licensed Insolvency Trustees to review all of your options, including doing nothing, debt consolidation, credit counselling, bankruptcy and Consumer Proposals. This initial consultation includes the development of a summary of your debts, assets, income and expenses. We will also have a discussion on what assets are exempt in your province and what the term surplus income would mean if you were to consider filing for bankruptcy. After going through your options, if a Consumer Proposal is the ideal debt relief option for your unique situation, we will then review the process with you in detail and help you prepare the offer you would like to present to your secured creditors.

Consumer Proposals are designed to be as flexible as possible — the only restriction being they cannot run longer than five years. Your Trustee (called an Administrator, when filing a Consumer Proposal) will file all required documents with the Office of the Superintendent of Bankruptcy (OSB), including a Statement of Affairs (a sworn declaration of your assets, debts, income and expenses) and the actual Consumer Proposal (a formal offer to settle with your unsecured creditors). Your Administrator will also prepare a report to the creditors explaining the proposal and why the Administrator recommends the creditors accept the proposal. The Administrator will notify all the creditors and will arrange for any legal proceedings or garnishees to be halted.

45 days after the proposal is filed the Administrator will review all the claims filed by your creditors and their voting letters. If a majority of the dollars owed vote in favour of the proposal, it is considered accepted and all unsecured creditors are bound by it (some minor exceptions apply). If they do not accept the proposal a creditor meeting is called shortly after to see if an amended proposal can be worked out between you and your creditors. The Administrator will assist with this process. Regardless of whether the initial proposal or an amended proposal is accepted, the terms are binding on all of your unsecured creditors.

Once your Consumer Proposal is accepted, you will make all payments agreed upon within the proposal. These payments may take the form of a regular monthly payment for a period of time, a lump sum derived from family members or via remortgaging your home, or any other source as outlined in the proposal. You are also required to attend two counselling sessions on budgeting, rebuilding your credit rating and other long-term debt management strategies. Once you have paid the Consumer Proposal in full and completed the counselling sessions, you will receive your Certificate of Completion and be released from all the unsecured debts you owed on the day you filed (with minor exceptions which your Advisor will discuss with you).

During your mandatory counselling sessions, we will discuss with you ways to restore your credit rating both during the Consumer Proposal period and afterwards. During these sessions, we also will discuss the causes of your financial difficulty and how to capitalize on your Life-Changing Debt Solution moving forward. Generally the restoration of your credit will take a year or two, but once your Consumer Proposal is complete, you will have no remaining unsecured debts and can focus on getting back to living.

2025-11-11

Bankruptcy

You may be considering filing for Bankruptcy — and worried about who may find out. Learn who will be notified when you declare Bankruptcy.

2025-11-10

Lifestyle Debt Debt Solutions

Whether operating a small business, or large enterprise, there is a lot at stake for Canadian entrepreneurs.

2025-11-10

Lifestyle Debt Debt Solutions

These five practical tips can help you navigate interactions with the CRA more smoothly — and keep your peace of mind throughout the process.