MNP Consumer Debt Sentiment Survey reveals serious concern about debt in Manitoba and Saskatchewan:

- Fifty-seven per cent are concerned about their current level of debt (a jump of 14 per cent since February 2016).

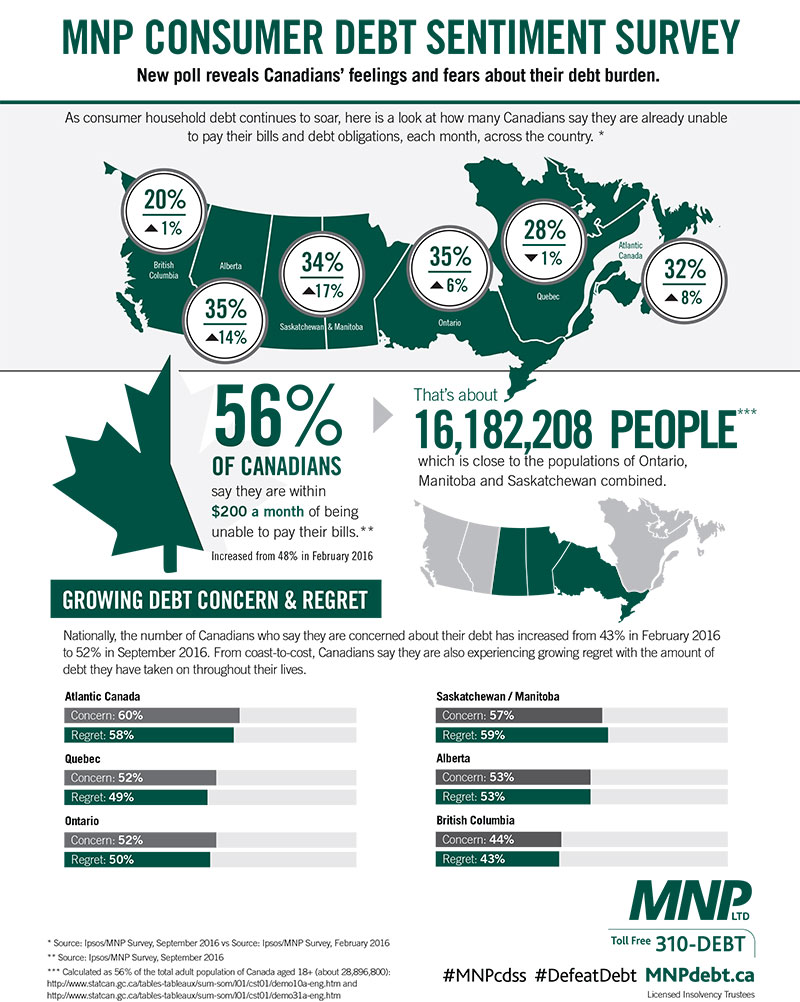

- Thirty-four per cent say they already don’t make enough to cover their bills and debt payments. This number is up 17 per cent since February 2016 and represents the largest jump in the country.

- Regret about debt is strongest in Manitoba and Saskatchewan compared to other provinces, with fifty-nine percent saying they regret the amount of debt they’ve taken on (up 15 per cent from February 2016).

Winnipeg, Manitoba – A huge portion of residents of Manitoba and Saskatchewan are concerned about their level of debt and their ability to meet their payment obligations. Sixty-four per cent of residents now say they are $200 or less per month away from not being able to meet all of their bills or debt obligations each month. Thirty-four per cent of this group say they already don’t make enough money to cover their bills and debt payments, technically making them financially insolvent. Both figures jumped 17 per cent since the poll was conducted in February 2016, and are some of the largest increases in the country compared to other provinces.

The findings are a part of the MNP Consumer Debt Sentiment Survey, a semi-annual poll designed to track Canadians’ feelings about their debt and their perception of their ability to meet their monthly payment obligations. Fifty-seven per cent of respondents in Manitoba and Saskatchewan said they are concerned about their current level of debt, the second highest proportion in the country behind Atlantic Canada. That number represents an increase of 14 per cent since February 2016. For many, this is prompting some soul-searching, with 59 per cent also now indicating that they regret the amount of debt that they have taken on, the largest proportion in the country.

Gord Neudorf, a Winnipeg-based Licensed Insolvency Trustee with MNP Debt who has seen a significant increase in insolvency filings over the last year, says that the low interest environment lured people into what he calls the ‘monthly payment mentality’.

“It’s a mentality of making a purchase decision based upon the amount of the monthly payment as opposed to considering the affordability of the purchase price. This mentality has compounded to the point where many folks are living a lifestyle they can’t afford. Because of low interest rates, many have been lured into making poor credit and debt decisions and now the cracks are starting to widen,” he says.

The survey showed that there has been a significant jump in the number of people in Manitoba and Saskatchewan concerned about the potential of rising interest rates. Forty-one per cent now say they are concerned that an increase in interest rates could move them towards bankruptcy. That number is up 16 per cent from the February 2016 survey.

“In Manitoba, I see many young people going “all in” on a big custom home and two nice vehicles, many of the luxury variety, where the monthly mortgage and loan payments may be doable in the short term but end up being unsustainable in the long term when the eventual unexpected costs start to arise. Couple this with the temptations to use credit to get the latest technology, go out for dinner often and get away for a winter vacation many folks are essentially spending themselves into an endless cycle of debt. Those who are living on credit should seek professional help now. One of the biggest mistakes people make is waiting until the point of no return before getting help,” said Neudorf.

Other key poll highlights include:

- Fifty-six per cent of Canadians now say they are $200 or less per month away from not being able to meet all of their bills or debt obligations each month, including 31 per cent who say they already don’t make enough money to cover them, technically making them financially insolvent. The proportion of Canadians who say they can’t pay their bills is up 5 per cent since early 2016 and 10 per cent from February 2015.

- The concern about the potential for rising interest rates has increased among Canadians. Thirty-eight per cent say they are concerned an increase in interest rates could move them towards bankruptcy, compared to only 31 per cent back in February 2016.

- Parents are more likely to be concerned about their debt situation than other Canadians: six in ten (60 per cent) parents are concerned with their level of debt. Debt concerns are also much stronger among younger Canadians: more than half (55 per cent) of Millennials aged 18-34 are concerned about their debt situation, compared to 45 per cent of Gen Xers and just 29 per cent of Baby Boomers.

- Concern about debt is strongest in the Atlantic provinces where 60 per cent worry about their current debt load, compared with 57 per cent of those in Manitoba and Saskatchewan, 53 per cent in Alberta, 52 per cent in Ontario, 52 per cent in Quebec and 44 per cent in B.C.

- Feelings of regret about debt are most present in Manitoba and Saskatchewan (59 per cent), followed closely by the Atlantic provinces (58 per cent), Alberta (53 per cent), Ontario (50 per cent), Quebec (49 per cent) and B.C. (43 per cent).

- In Alberta, there was an 18 per cent increase in the number of residents who said they are $200 or less per month away from not being able to meet their bills each month. That represented the largest jump across the country followed closely by Manitoba and Saskatchewan (17 per cent).

- Residents of Ontario (35 per cent) and Alberta (35 per cent) are the most likely to describe themselves as financially insolvent, followed closely by Manitoba and Saskatchewan (34 per cent), the Atlantic provinces (32 per cent), Quebec (28 per cent) and B.C. (20 per cent).

About MNP Debt

MNP LTD, a division of MNP LLP, is one of the largest personal insolvency practices in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working collaboratively with individuals to help them recover from times of financial distress and regain control of their finances. With more than 200 Canadian offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit www.MNPdebt.ca to learn more.

About the MNP Consumer Debt Sentiment Survey

Now in its second year, the MNP Consumer Debt Sentiment Survey is a semi-annual poll designed to track Canadians’ feelings about their debt and their perception of their ability to meet their monthly payment obligations.

The survey was conducted by Ipsos on behalf of MNP Debt between September 6 and September 12, 2016. For this survey, a sample of 1,502 Canadians from Ipsos' online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/ - 2.9 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population.