One in three already technically insolvent, up six points

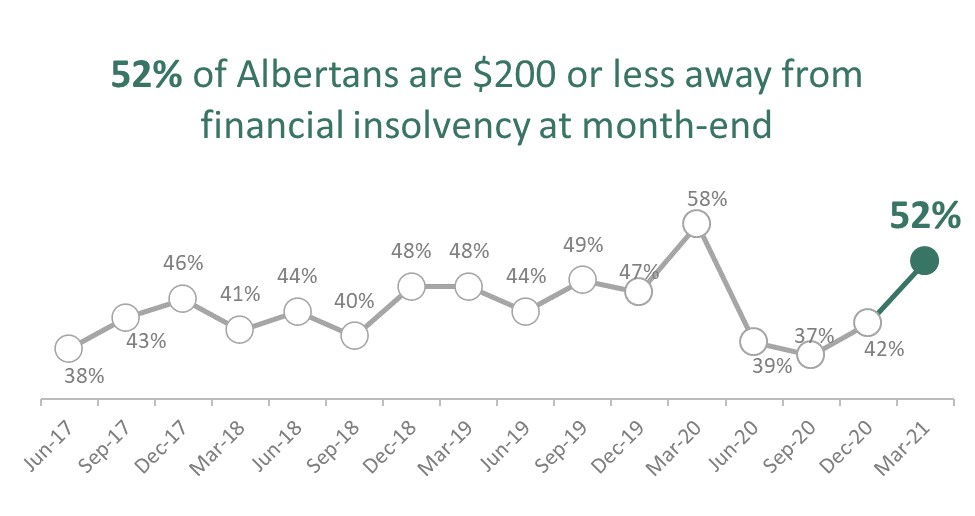

CALGARY, AB – April 8, 2021 – As pandemic-related government aid and loan deferral programs begin to wind down, the latest MNP Consumer Debt Index finds the number of Albertans hovering close to financial insolvency has jumped back up to pre-pandemic levels. More than half (52%) say they are $200 or less away from not being able to meet all of their bills and debt obligations each month, a whopping 10-point jump from December. This includes three in 10 (31%, +6pts) who report they are already insolvent with no money left to cover their payments at month-end.

“Pandemic-related financial relief measures provided some much-needed breathing room over the last year, but now we’re seeing a rapid reversal,” says Donna Carson, a Licensed Insolvency Trustee with Alberta-based MNP LTD. “The number of Albertans with virtually no wiggle room in their household budgets has increased significantly in the last three months, which suggests that we may start to see some falling behind on payments.”

Conducted quarterly by Ipsos and now in its sixteenth wave, the Index finds households report having less money left over at the end of the month. On average, Albertans say they are left with $620 after making their payments, down by $73 (or 11 percent) from December. The decline is likely a reflection of government aid programs, eviction bans, and payment relief measures ending.

“Some Albertans may be seeing their bills coming due even if they are not back to full-time work or full wages,” says Carson. “While many are spending less and saving more as a result of pandemic measures, others are feeling more anxiety or having to increase their debt to stay afloat after job, wage, or small business loss.”

More than a quarter (28%) of Albertans say they have taken on more debt because of the pandemic. This includes using credit cards (14%), using a line of credit (6%), taking out a bank loan (6%), or deferring mortgage payments (5%). Almost one in five (38%) have also reported drawing from emergency savings to pay household bills.

“Households taking on more debt because they are falling behind on payments become extremely vulnerable to interest rate increases in the future,” explains Carson.

Half (50%) are concerned about their ability to repay debts if interest rates rise, while four in 10 (40%) are concerned rising interest rates could move them towards Bankruptcy.

Despite the concern, six in 10 (64%) believe now is a good time to buy things that they otherwise couldn’t afford (-1). In addition, four in 10 (43%) say they’re more relaxed about carrying debt than usual (+1).

“Unfortunately, taking on credit is a poor option for most as it can create a debt trap that’s near impossible to get out of,” says Carson, who is urges Albertans to be proactive about improving their financial positions and to seek professional advice concerning unmanageable consumer debt.

However, it seems many plan to do exactly what Carson cautions against: taking on even more credit to pay their expenses. Albertans are significantly more likely (36%) than any other province to say they anticipate taking on more debt over the next year to pay bills — including using high-interest options like credit cards (9%) or payday loan service (4%).

“Anyone who finds themselves taking on more debt to pay bills should seek professional debt advice right away. Stigma and embarrassment cause many people to struggle for years before getting help. Licensed Insolvency Trustees offer free, unbiased advice about your individual situation and the options available,” says Carson.

Carson explains that Licensed Insolvency Trustees may recommend one or a combination of the following options depending on the extent of the debt and the individual’s overall financial situation:

Budgeting — Setting up a monthly financial plan to help balance and monitor income and expenses and potentially free up more cash to pay down debt.

Refinancing — Re-negotiating the term and interest rate on existing credit accounts to reduce the monthly cost of debts and make them easier to repay.

Liquidating — Selling high-value assets such as non-essential vehicles, recreational properties, sporting goods, and jewelry to provide the financing to pay down debt.

Consolidating — Combining all debts into a single monthly payment with a lower average interest rate to reduce the number of payments and their total cost.

Consumer Proposal — Working with a Licensed Insolvency Trustee to negotiate a legally binding debt settlement with creditors that will reduce the amount owed and can be paid over a maximum of five years. Consumer Proposals can only be administered by Licensed Insolvency Trustees.

Bankruptcy — A legal process of liquidating assets and potentially making monthly payments to eliminate outstanding debts and help insolvent consumers achieve a financial fresh start. A Bankruptcy may only be administered by a Licensed Insolvency Trustee.

Government-regulated Licensed Insolvency Trustees are empowered to help Albertans reorganize their financial affairs and, where appropriate, can even help them avoid Bankruptcy by facilitating an agreement with their creditors. They can also guarantee legal protection from creditors through the Consumer Proposal or Bankruptcy processes.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 240 offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools. For regular, bite-sized insights about debt and personal finances, subscribe to the MNP 3 Minute Debt Break Podcast.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians.

Now in its sixteenth wave, the Index currently stands at 96 points, up seven points compared to the last wave conducted in December 2020. Visit MNPdebt.ca/CDI to learn more.

The latest data, representing the sixteenth wave of the MNP Consumer Debt Index, was compiled by Ipsos on behalf of MNP LTD between March 4-9, 2021. For this survey, a sample of 2,001 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error and measurement error.