2025-10-06

Ontarians face ‘heat or eat’ decisions as financial strain deepens

MNP Consumer Debt Index

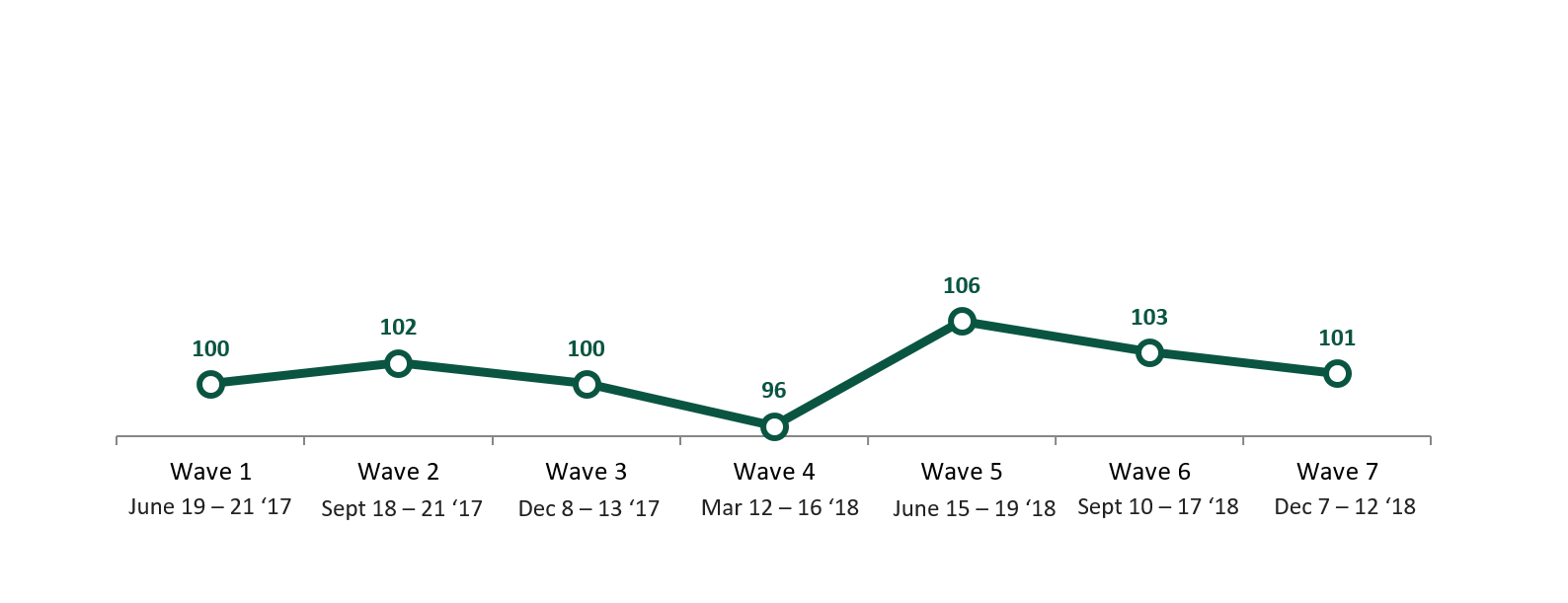

Ontarians’ financial vulnerability is intensifying as persistent economic uncertainty, concerns about borrowing costs, and employment anxiety weigh on household confidence.