Canadians Increasingly Pessimistic About Their Consumer Debt

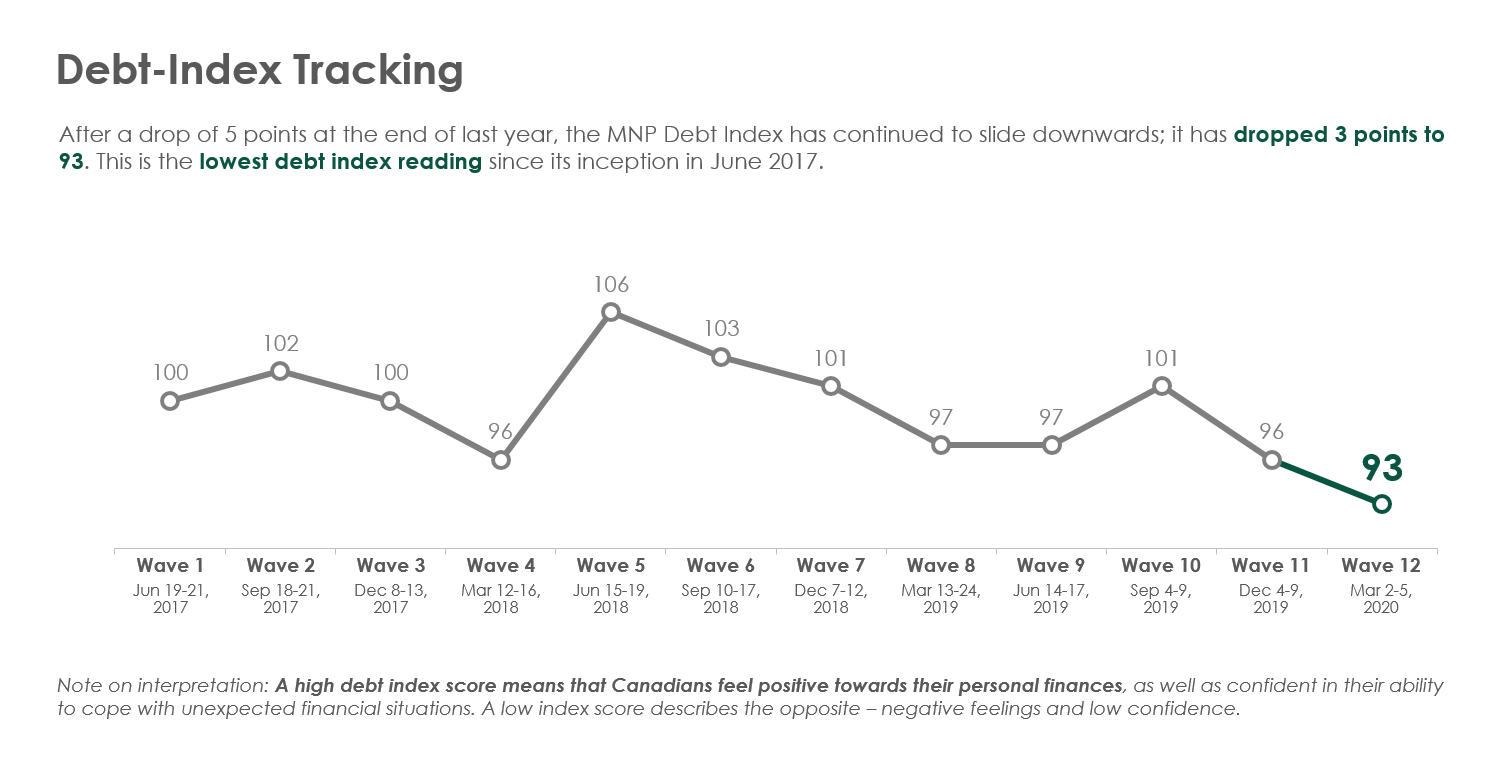

Now in its eleventh wave, the MNP Consumer Debt Index has dropped five points since September (96 points), matching the lowest ever recorded back in March 2018. The drop is not only driven by increasing pessimism among Canadians about their financial futures — Canadians also feel worse off now compared to the past. In fact, net optimism for both one- and five-year timeframes have reached all-time lows or near all-time lows. One in five Canadians now say their debt situation is worse than it was five years ago.More Canadians see grey skies on the horizon heading into the new year and beyond as fewer expect their debt situation to improve, according to the latest MNP Consumer Debt Index conducted quarterly by Ipsos. Canadians’ net confidence in their financial futures a year down the road dropped five points since September. When comparing their current debt situation to five years in the future, net confidence dropped six points.