MNP Consumer Debt Index drops 4 points underscoring Canadians’ deteriorating financial situation

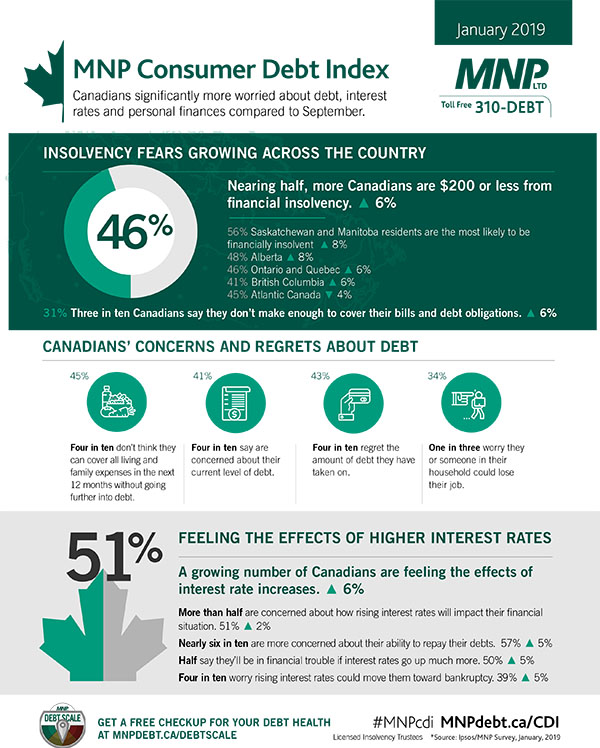

Canadians are feeling worse about their consumer debt and personal finances than was the case just three months ago. The MNP Consumer Debt Index has fallen four points since December, signalling growing concern and deteriorating financial stability for many.

The quarterly survey, conducted by Ipsos on behalf of MNP LTD, shows more Canadians are hovering close to financial insolvency at the end of the month; nearly half (48%) of Canadians say they are $200 or less each month away from financial insolvency, an increase of two points. This includes one in four (26%) who say they have no wiggle room at month-end, as they already don’t make enough to cover their bills and debt payments.