Fifty-eight per cent of Albertans say they are now living within $200 a month of being unable to pay their bills and debt payments each month

MNP Consumer Debt Sentiment Survey reveals Albertans’ feelings and fears about their debt:

- Fifty-three per cent are concerned about their current level of debt (up 11 points since February).

- Thirty-five per cent now say they don’t make enough to cover their bills and debt payments (up 14 points since February).

- Almost forty per cent are concerned that rising interest rates could move them toward bankruptcy (up 9 points since February).

- Over half regret the amount of debt they’ve taken on (up 7 points since February).

Calgary, AB – Alberta’s consumer debt is the highest in the country and a new survey shows that Albertans are growing increasingly concerned about their ability to meet their payment obligations. Fifty-eight per cent of Albertans now say they are $200 or less per month away from not being able to meet all of their bills or debt obligations each month, an increase of 18 points since February 2016. Thirty-five per cent of this group say they already don’t make enough money to cover them, technically making them financially insolvent. That number represents an increase of 14 points over the same period.

The findings are a part of the MNP Consumer Debt Sentiment Survey, a semi-annual poll designed to track Canadians’ feelings about their debt and their perception of their ability to meet their monthly payment obligations. The survey showed that the number of Albertans who are concerned about their current debt situation is up over 10 points since February 2016. At that time, four in ten (42 per cent) of Albertans said they were concerned, now over half (53 per cent) of Albertans feel that way. The same number regret the amount of debt they have taken on.

“Given the downturn in Alberta, it’s not surprising that Albertans are concerned about their finances. What is surprising is the number who say they are living on the edge of financial crisis. With so many feeling unable to cover their bills and debts, there is tremendous vulnerability to any kind of economic shock; the loss of a job, an emergency, a divorce, even things like a reduction in overtime pay or bonuses or an increase in interest rates,” said Donna Carson, a Calgary-based Licenced Insolvency Trustee with MNP Debt.

The survey showed that there is real concern about the potential for rising interest rates among Albertans. Thirty-nine per cent say they are concerned an increase in interest rates could move them towards bankruptcy, compared to only thirty per cent in February 2016.

Despite the anxiety around debt, over-spending remains a reality. Forty-three per cent of parents in Alberta said they spent more than budgeted on back-to-school shopping for their kids, while 33 per cent ‘agree’ they spent over budget on recreation or vacations during the summer.

“Albertans have come to rely on cheap credit to fund their lifestyles and a significant number are now adding even more debt obligations as a result of job losses. But interest rates will eventually rise. Those who already feel overwhelmed by their debt should seek professional help now. One of the biggest mistakes people make is waiting until the point of devastation before getting help,” said Carson.

Other key poll highlights include:

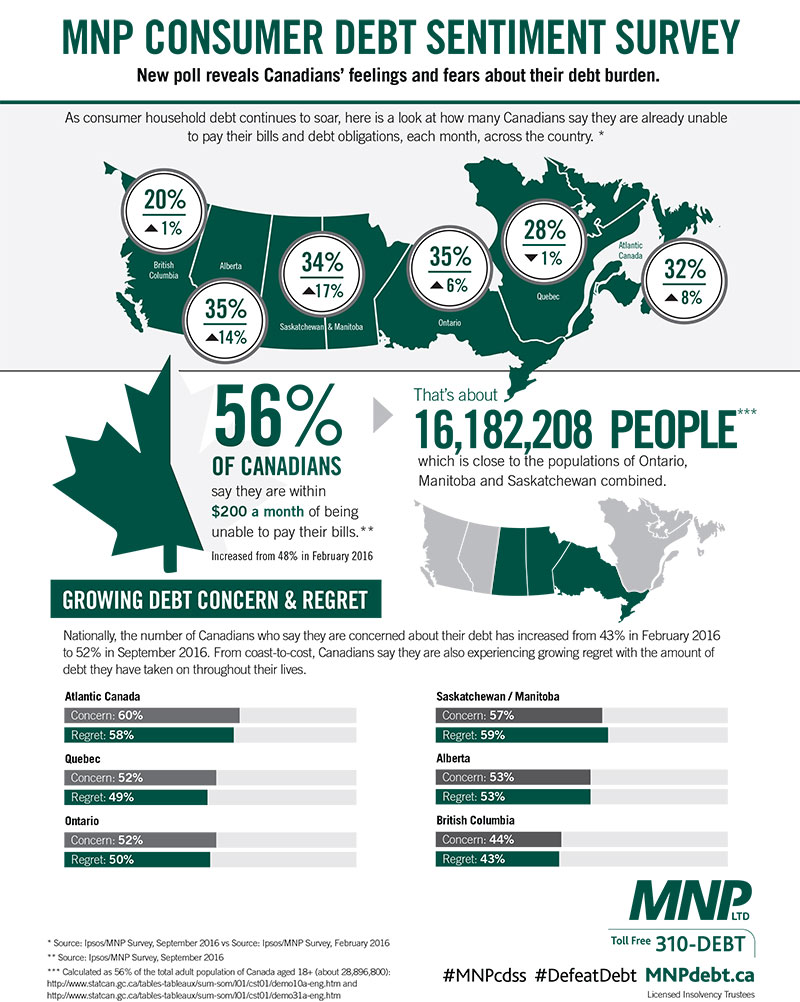

- Residents of Ontario (35 per cent) and Alberta (35 per cent) are the most likely to describe themselves as financially insolvent, followed closely by Saskatchewan and Manitoba (34 per cent), the Atlantic provinces (32 per cent), Quebec (28 per cent) and BC (20 per cent).

- In Alberta there was an eighteen point increase in the number of residents who said they are $200 or less per month away from not being able to meet their bills each month. That represented the largest jump across the country followed closely by Saskatchewan and Manitoba (17 per cent).

- Fifty-six per cent of Canadians now say they are $200 or less per month away from not being able to meet all of their bills or debt obligations each month, including 31 per cent who say they already don’t make enough money to cover them, technically making them financially insolvent. The proportion of Canadians who say they can’t pay their bills is up 5 points since early 2016 and 10 points since February 2015.

- The concern about the potential for rising interest rates has increased among Canadians. Thirty-eight per cent say they are concerned an increase in interest rates could move them towards bankruptcy, compared to only thirty-one per cent back in February 2016.

- Parents are more likely to be concerned about their debt situation than other Canadians: six in ten (60 per cent) parents are concerned with their level of debt.

- Debt concerns are also much stronger among middle-aged Canadians; six in ten (60%) Gen Xers are concerned about their debt situation, compared to 52% of Millennials and 43% of Baby Boomers.

- Concern about debt is strongest in the Atlantic provinces where 60 per cent worry about their current debt load, compared with 57 per cent of those in Saskatchewan and Manitoba, 53 per cent in Alberta, 52 per cent in Ontario, 52 per cent in Quebec, and 44 per cent in BC.

- Feelings of regret about debt are most present in Saskatchewan and Manitoba (59 per cent), followed closely by the Atlantic Provinces (58 per cent), Alberta (53 per cent), Ontario (50 per cent), Quebec (49 per cent) and BC (43 per cent).

About MNP Debt

MNP LTD, a division of MNP LLP, is one of the largest personal insolvency practices in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working collaboratively with individuals to help them recover from times of financial distress and regain control of their finances. With more than 200 Canadian offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit www.MNPdebt.ca to learn more.

About the MNP Consumer Debt Sentiment Survey

Now in its second year, the MNP Consumer Debt Sentiment Survey is a semi-annual poll designed to track Canadians’ feelings about their debt and their perception of their ability to meet their monthly payment obligations.

The survey was conducted by Ipsos on behalf of MNP Debt between September 6 and September 12, 2016. For this survey, a sample of 1,502 Canadians from Ipsos' online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/ - 2.9 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population.

Latest Blog Posts

2025-10-06

Caryl Newbery-Mitchell

MNP Consumer Debt Index

Ontarians’ financial vulnerability is intensifying as persistent economic uncertainty, concerns about borrowing costs, and employment anxiety weigh on household confidence.

Read More

arrow_forward

2025-10-06

Pamela Meger

MNP Consumer Debt Index

The financial vulnerability of Saskatchewan and Manitoba residents is intensifying as their financial cushions shrink and more households edge closer to insolvency.

Read More

arrow_forward

2025-10-06

Lindsay Burchill

MNP Consumer Debt Index

Albertans’ financial vulnerability is intensifying as persistent economic uncertainty, concerns about borrowing costs, and employment anxiety weigh on household confidence.

Read More

arrow_forward