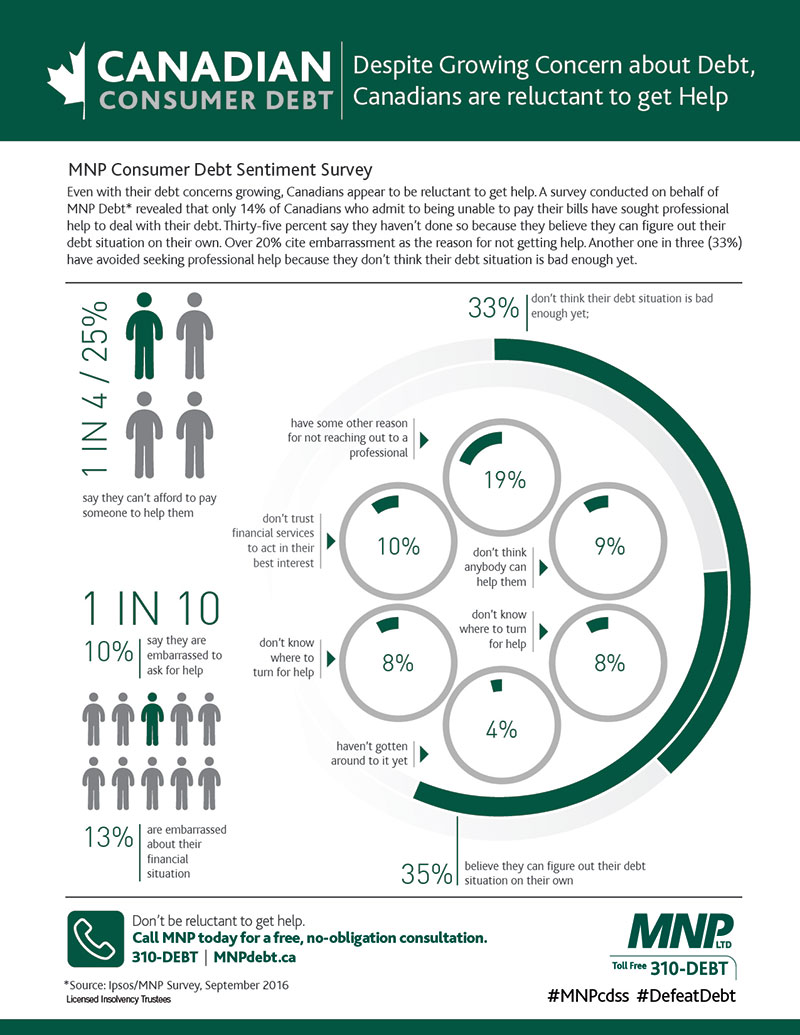

September 30, 2016 - Even with their debt concerns growing, Canadians appear to be reluctant to get help. A survey from MNP Debt revealed that only 14 per cent of Canadians who admit to being unable to pay their bills have sought professional help to deal with their debt. Thirty-five per cent say they haven’t done so because they believe they can figure out their debt situation on their own. Over 20 per cent cite embarrassment as the reason for not getting help. Another one in three (33 per cent) have avoided seeking professional help because they don’t think their debt situation is bad enough yet.

“The bottom line is that if you are using credit to subsidize your income, then you need help. Get professional financial advice from someone who can help you create a plan to start living within your means and then start paying down debt,” says Donna Carson, a Licensed Insolvency Trustee with MNP Debt. “If you are receiving calls from creditors, then your situation critical. You need help immediately before you run out of options.”

According to the survey, over 1.1 million Canadians feel that bankruptcy is inevitable for them based on their current inability to pay their bills. Statistics released Friday by the Office of the Superintendent of Bankruptcy indicate that the total number of insolvencies (bankruptcies and proposals) in Canada decreased by 8.1 percent from July 2015 to July 2016. Meanwhile in Alberta, the total number soared almost 25 per cent compared to the previous year.

“The biggest mistake people make is allowing their debt problems to snowball. By the time they are forced to get help their homes are at risk, their accounts have gone to collections and their wages are being garnished. The earlier people seek help, the more options they will have for dealing with their debt,” said Carson.

Licensed Insolvency Trustees are the only debt professionals that can guarantee legal protection from creditors through proposals and bankruptcies. MNP Debt offers free consultations to help clients understand their options including consumer proposals, orderly payment of debts, debt consolidation, credit counselling or an informal debt settlement.

Reasons Canadians struggling with their bills are not seeking professional debt help:

- 35 per cent believe they can figure out their debt situation on their own;

- 33 per cent don’t think their debt situation is bad enough yet;

- One in four (25 per cent) say they can’t afford to pay someone to help them;

- One in ten (13 per cent) are embarrassed about their financial situation; and

- One in ten (10 per cent) say they are embarrassed to ask for help

- 10 per cent just don’t trust financial services to act in their best interest;

- 9 per cent don’t think anybody can help them;

- 8 per cent don’t know where to turn for help;

- 8 per cent haven’t gotten around to it yet;

- 4 per cent say bankruptcy is inevitable to them;

- 19 per cent have some other reason for not reaching out to a professional.

About the Survey

The survey was conducted by Ipsos on behalf of MNP Debt between September 6 and September 12, 2016. For this survey, a sample of 1,502 Canadians from Ipsos' online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/ - 2.9 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population.