Stable interest rates are a cold comfort to those already struggling to make ends meet.

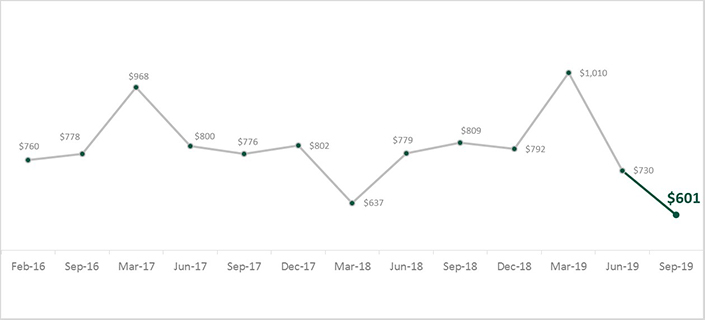

Vancouver, BC – October 28, 2019 – Despite the Bank of Canada stating it will keep interest rates stable until next year, nearly half (48%) of British Columbians say they are more concerned about their ability to repay debts than they used to be. This could be the result of declining wiggle room in household budgets. After paying all their bills and debt obligations, British Columbians say they have $601 left at the end of the month on average — a drop of $129 since June and the lowest level since tracking began in February 2016. Nearly half (45%, +1) say they are left with less than $200, including three in ten (26%) who already don’t make enough money to cover all their bills and debt obligations (+2 pts).

The findings are part of the latest MNP Consumer Debt Index conducted quarterly by Ipsos. Now in its tenth wave, the Index tracks Canadians’ attitudes about their consumer debt and perception of their ability to meet monthly payment obligations.

Average Finances Left at Month-End

“There is less and less wiggle room in household budgets in the province, which make many increasingly vulnerable to unexpected expenses or increases in living costs,” says Lana Gilbertson, a Vancouver-based Licensed Insolvency Trustee with MNP LTD — the country’s largest personal insolvency practice. “Many British Columbians don’t have enough to cover their bills each month, let alone put anything away for a rainy day. That is concerning because it is most often unexpected expenses that derail personal finances.”

It’s no surprise that, with less in the bank at month-end, British Columbians’ ability to cope with unexpected expenses has shaken. Seven in ten (68%) are not confident in their ability to cope with life-changing events — such as a divorce, unexpected auto repairs, loss of employment or the death of a family member — without increasing their debt.

“Unexpected expenses are most devastating for severely indebted individuals because they are forced to take on more debt they can’t afford and that begins a cycle of increasing servicing costs and eventual default,” says Gilbertson, who recommends having at least three to six months of expenses saved in case of emergencies.

British Columbians may have fewer dollars left at month-end to buffer them from sudden expenses, but, somewhat surprisingly, they are growing generally more positive about their personal financial situations. According to the index, 3 in 10 (28%) say their debt situation is better than it was a year ago (+5 pts) and around the same number (36%) say it is better than 5 years ago (+3 pts). In addition to being optimistic about the present, an even greater proportion feel more positive about the future, with 4 in 10 (39%) expecting their debt situation will be better a year from now (+1 pt) and half (51%) believing it will be better five years from now (+3 pts).

“The current holding pattern on interest rates may be giving British Columbians a sense of relief about mortgage payments and other debts. Still, the fact remains many are far into the red without a clear path to repayment,” says Gilbertson, pointing to evidence from the research showing many may intend to take on more credit to make ends meet over the next year.

Just about half (45%) of British Columbians say they don’t think they will be able to cover all their living and family expenses for the next 12 months without going further into debt, unchanged since June. Furthermore, about the same number (46%) are confident they won’t have any debt in retirement, a two-point drop.

“Some have resigned themselves to the fact they may never be debt free. Even if interest rates remain stable, that is a cold comfort to those already having struggling to make ends meet,” says Gilbertson.

A large portion of British Columbians (49%) are concerned about how rising interest rates will impact their financial situation (-2 pts). Although down 10 points since June, 43 percent still agree they are afraid they will be in financial trouble if interest rates go up much more. Finally, a third (33%) are still concerned rising interest rates could move them towards bankruptcy (-4 pts).

“If you feel like your debt is out of control, get professional help. Even if you have a significant amount of credit card debt, a line of credit, mortgage, car loan — or all of the above — there are debt relief options,” says Gilbertson.

MNP LTD offers Free Confidential Consultations with Licensed Insolvency Trustees to help individuals understand their debt relief options. Licensed Insolvency Trustees are the only government-regulated debt professionals who offer a full range of debt relief options and can guarantee legal protection from creditors through Consumer Proposals and Bankruptcies.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 230 offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians. Visit www.MNPdebt.ca/CDI to learn more.

The latest data, representing the tenth wave of the MNP Consumer Debt Index, was compiled by Ipsos on behalf of MNP LTD between September 4 – 9, 2019. For this survey, a sample of 2,002 Canadians aged 18 years and over was interviewed. The precision of online polls is measured using a credibility interval. In this case, the results are accurate to within +2.5 percentage points, 19 times out of 20, of what the results would have been had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error.

A summary of the provincial data is available by request.