Saskatchewan and Manitoba residents admit to bad financial habits including:

- Being lured in by deals or offers by companies on days such as Black Friday, Boxing Day, etc. (14%)

- Paying only the minimum balance on a credit card (26%) or line of credit (12%)

- Borrowing money they can’t afford to pay back quickly (15%)

- Making a major purchase on credit without paying it off right away (16%)

- Buying something on credit that requires no payments for a while (10%)

WINNIPEG, MB – As the shopping rush reaches peak intensity before the holidays, a local debt expert is warning Saskatchewan and Manitoba residents to avoid taking on more debt or payday loans, as they try to cope with the pressures of last minute gifts and Christmas grocery shopping.

“Right before the holidays is when people feel that mounting pressure to buy, buy, buy, and many are tempted to borrow money from a payday lender or overextend themselves on credit cards to do so. Unfortunately, these forms of credit often trap them in a cycle of debt, due to the extremely high interest rates which make repaying the debt nearly impossible,” says Gord Neudorf, a Licenced Insolvency Trustee at MNP Ltd.

A new poll conducted by MNP on behalf of Ipsos highlights some bad financial habits that are exacerbated by the holiday shopping season. Fourteen per cent admit to being lured in by sales on ‘deal’ days like Black Friday or Boxing Day. One in ten (10%) said they have bought something on credit that requires no payments for a while.

“What might seem like a small purchase or a great Boxing Day deal now may not really a bargain in the long run, if you end up carrying those purchases on credit. So be wary of the barrage of holiday sales and those ‘buy now, pay later’ offers,” says Neudorf.

Close to three in ten (26%) admit to only paying the minimum balance on their credit card while one in ten pay the minimum balance on their line of credit (12%). Sixteen per cent say they have made a major purchase on credit without paying it off right away. About the same number (15%) say they borrowed money they can’t afford to pay back quickly. Nearly one in ten (8%) admit they have even used their home-equity line of credit to buy things they want but don’t need.

“If you decide that using credit cards or borrowing is absolutely necessary, you need to be aware of the true cost of that debt. When you see the sticker price on an item, don’t forget to add the potential interest accrued, so you can get a better picture of what it will really cost you. I think you’ll find that ‘deal’ suddenly isn’t so enticing anymore,” says Neudorf.

Come January, residents of Saskatchewan and Manitoba anticipate feeling the effects of a credit hangover. Last year almost half (47%) felt anxiety over the arrival of holiday-spending bills, and four in ten (41%) regretted how much they spent. However, forty-four per cent said they made it their new year’s resolution to get their finances back on track.

“There’s no reason to wait until the New Year. Start making a plan now to tackle your debt repayment obligations. If you’re already feeling overwhelmed by holiday or other accumulated debts, I recommend you seek professional advice right away. The most important change you can make is to shop more thoughtfully and spend less. After all, the holidays are about your presence, not the presents,” advises Neudorf.

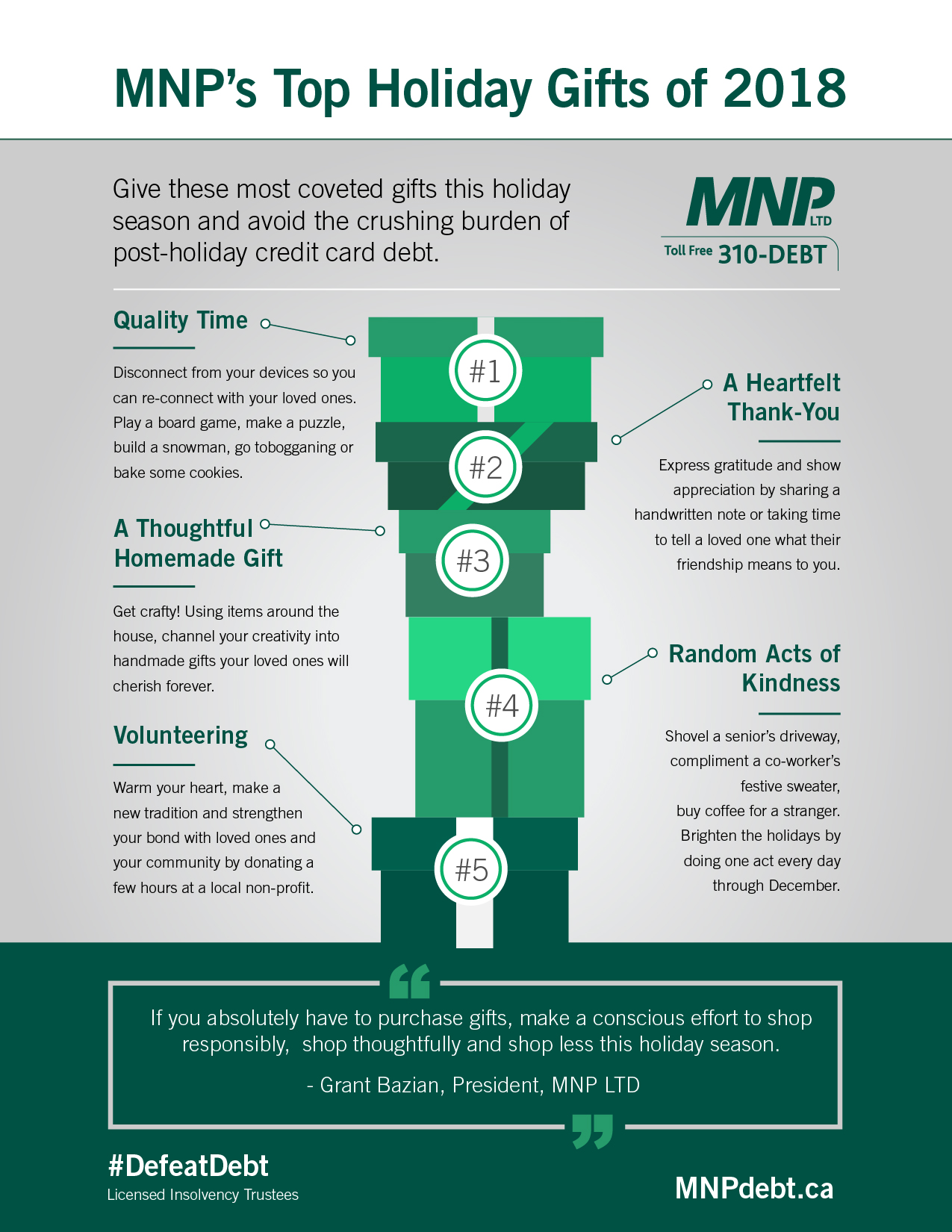

With the holiday spirt in mind, MNP Ltd, has re-released an ‘un-shopping’ holiday gift guide designed to help minimize the crushing burden of post-holiday debt.

MNP’s Holiday Gift Guide - 2018

It’s about your presence, not the presents!

1. Quality time

One of the best gifts you could give someone is your time. Spending valuable time with your loved ones creates more meaningful memories. Disconnect from your devices so you can re-connect with your loved ones. Play a board game, make a puzzle, build a snowman, go tobogganing or bake some cookies. Volunteer to babysit your nieces and nephews while their parents get that much needed break or spend time together as a family cooking a holiday meal.

2. A heartfelt ‘thank you’

In a time where emails and messages are the preferred means of communication, take the time to express gratitude and show appreciation by sharing a handwritten note or telling a loved one what their friendship means to you.

3. Thoughtful homemade gifts

Bring out the creative side in you and make a gift for your loved ones. Not only can you create something they are sure to love, but you can also customize it to suit their taste. Between Pinterest and Youtube you’ll find all the inspiration you need to unleash your creativity, and build something your loved ones are sure to cherish for a long time.

4. Volunteering

Nothing boosts your spirits and makes you feel as great as helping someone in need. Make a new tradition with family or your group of friends and donate a few hours at a local non-profit to help those in need.

5. Random acts of kindness

Shovel your neighbour’s driveway, compliment a co-worker’s festive sweater, and offer to help with cooking or baking. You can brighten the holidays by generously giving your time for random acts of kindness.

About MNP LTD

MNP LTD, a division of MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 230 Canadian offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit www.MNPdebt.ca to contact a Licensed Insolvency Trustee or get a free checkup for your debt health using the MNP Debt Scale.

About the Survey

The survey was compiled by Ipsos on behalf of MNP LTD between December 7 and 12, 2018. For this survey, a sample of 2,154 Canadians from the Ipsos I-Say panel was interviewed online. The precision of online polls is measured using a credibility interval. In this case, the results are accurate to within +/- 2.4 percentage points, 19 times out of 20, of what the results would have been had all Canadian adults been polled. Credibility intervals are wider among subsets of the population.