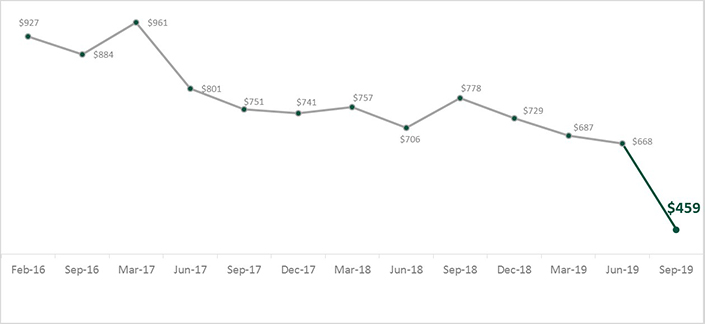

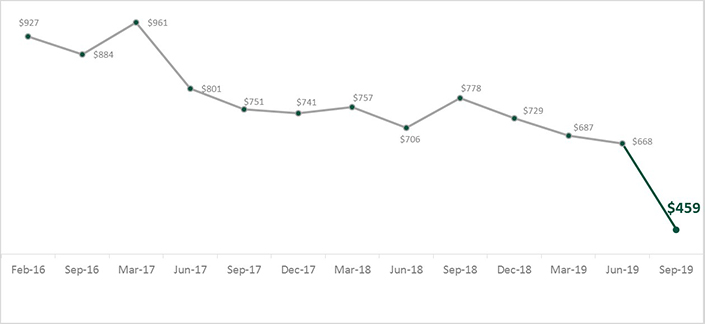

Calgary, AB –October 28, 2019 – Despite the Bank of Canada stating it will keep interest rates stable until next year, 6 in 10 (58%) Albertans say they are more concerned about their ability to repay their debts than they used to be. This could be the result of steeply declining wiggle room in household budgets. After paying all their current bills and debt obligations, Albertans say they have, on average, $459 left at the end of the month — a drop of $209 since June and the lowest level since tracking began in February 2016. Half (49%, +5 pts) say they’re left with less than $200; including 3 in 10 (34%) who say they already don’t make enough money to cover all their bills and debt obligations (+9 pts).

The findings are part of the latest MNP Consumer Debt Index conducted quarterly by Ipsos. Now in its tenth wave, the Index tracks Canadians’ attitudes about their consumer debt and perception of their ability to meet their monthly payment obligations.

Average Finances Left at Month-End

Albertans were asked: Thinking about the amount of after-tax income you make each month compared to the amount of your bills and debt obligations each month, how much is left over? In other words, how much wiggle room do you have before you wouldn't be able to pay all your bills and debt payments each month?

“There has been a marked decline in the amount of wiggle room households have in Alberta. says Donna Carson, a Calgary-based Licensed Insolvency Trustee with MNP LTD, the country’s largest personal insolvency practice. “Family budgets are strained by everyday expenses, which means many aren’t putting anything away for rainy day savings and that puts them at risk. Most often, it’s unexpected expenses that force people to take on more debt they can’t afford which begins a cycle of increasing servicing costs and eventual default.”

It’s no surprise that, with less in the bank at month-end, Albertans’ ability to cope with unexpected expenses has shaken. Seven in ten (70%) are not confident in their ability to cope with life-changing events — such as a divorce, unexpected auto repairs, loss of employment or the death of a family member — without increasing their debt.

“A job loss or an unexpected expense are most devastating for people who already have a large amount of debt. Our research continues to show just how vulnerable Alberta households are to inevitable life events like a car repair,” says Carson who recommends having at least three to six months of expenses saved in case of emergencies.

Albertans may have fewer dollars left at month-end to buffer them from sudden expenses, but, somewhat surprisingly, they are growing generally far more positive about their personal financial situations than those in other provinces. According to the index, one quarter (25%) say their debt situation is better than it was a year ago (+6 pts) and one in three (32%) say it is better than five years ago (+7 pts). In addition to being optimistic about the present, there has been a significant increase in the proportion who feel more positive about the future. Four in ten (44%) expect their debt situation a year from now will be better, a jump of 19 points. Six in ten (58%) believe it will be better five years from now (+13 pts).

“The current holding pattern on interest rates and increasing economic optimism in the province could be giving Albertans a sense of relief about their finances. Still, the fact remains many Albertans are deeply indebted and most don’t have a clear path to repayment,” says Carson, pointing to evidence from the research showing many intend to take on more credit to make ends meet over the next year.

Just about half (48%) of Albertans say they don’t think that they will be able to cover all their living and family expenses for the next 12 months without going further into debt, a one-point decrease since June. Furthermore, just under half (49%) are confident they won’t have any debt in retirement, a one-point increase.

“Some may have resigned themselves to being in debt for life. Interest rates may remain stable, but there are many already struggling to make ends meet at the current rate,” says Carson.

A large portion of Albertans (53%) are concerned about how rising interest rates will impact their financial situation, up one point since June. More than half (52%) agree if interest rates go up much more, they are afraid they will be in financial trouble (-4 pts). Finally, a third (35%) are still concerned that rising interest rates could move them towards bankruptcy (-7 pts).

“The single biggest mistake people make is taking on more debt to try and deal with debt. Even if you are swimming in credit card debt, with a line of credit, a mortgage, a car loan or all of the above, you can get help to design a debt relief strategy,” says Carson.

MNP LTD offers Free Confidential Consultations with Licensed Insolvency Trustees to help individuals understand their debt relief options. Licensed Insolvency Trustees are the only government-regulated debt professionals who offer a full range of debt relief options and can guarantee legal protection from creditors through consumer proposals and bankruptcies.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 230 offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians. Visit www.MNPdebt.ca/CDI to learn more.

The latest data, representing the tenth wave of the MNP Consumer Debt Index, was compiled by Ipsos on behalf of MNP LTD between September 4 – 9, 2019. For this survey, a sample of 2,002 Canadians aged 18 years and over was interviewed. The precision of online polls is measured using a credibility interval. In this case, the results are accurate to within +2.5 percentage points, 19 times out of 20, of what the results would have been had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

A summary of the provincial data is available by request.